|

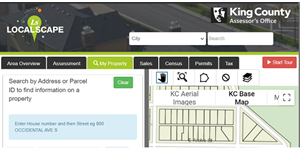

| "Localscape" - King County Assessor Transparency Tool |

King County Assessor John Wilson developed the invaluable Localscape "transparency assessor tool" to calculate individual 2024 taxes and levy rates based on your home's appraised value. Current and past taxes, area median household income, area sales, and copious other useful data is resourced.

In 1981, I bought my 1,800 sf home on Education Hill for $92,000. According to the calculator, the 2023 average sales price in my area is $1.2M.

My total property taxes in 2023 were $8961.80 (up $1,630 from 2022.) The calculator showed 2023 King County levy rates and dollar amounts on my property were, as follows:

- Local School 29.30% - $2475.48

- City 11.04% - $849.3

- County 10.9% - $1311.16

- Library 3.57% - $282.98

- EMS 2.85% - $222.24

- Hospital 2.57% - $151.47

- Transit 2.12% - $160.53

- Port 1.03% - $102.61

- Flood .92% - $69.26

- STATE Taxes $2467.16 (schools, fire, roads, parks & recreation)

2024 taxes will most likely increase from 2023 owing to voter approved levies and bonds. This year voters passed a 14 cent /$1000 property tax for the King County Mental Health Crisis Centers; and King County's Silver Cloud hotel in for the chronic homeless. LWSD will have a $676.9 million construction levy measure on the November ballot. (EvergreenHealth District No. 2 will propose a levy lid-lift August 2025.)

To check out the tax data on your home:

-- Bob Yoder, 7/1/2024

Excellent post!

ReplyDelete